Limit Orders

A limit order lets you set a specific price at which you want to buy or sell a token. This ensures you don't buy above or sell below a certain price, protecting your trades during volatile market cond

💵 Buy limit

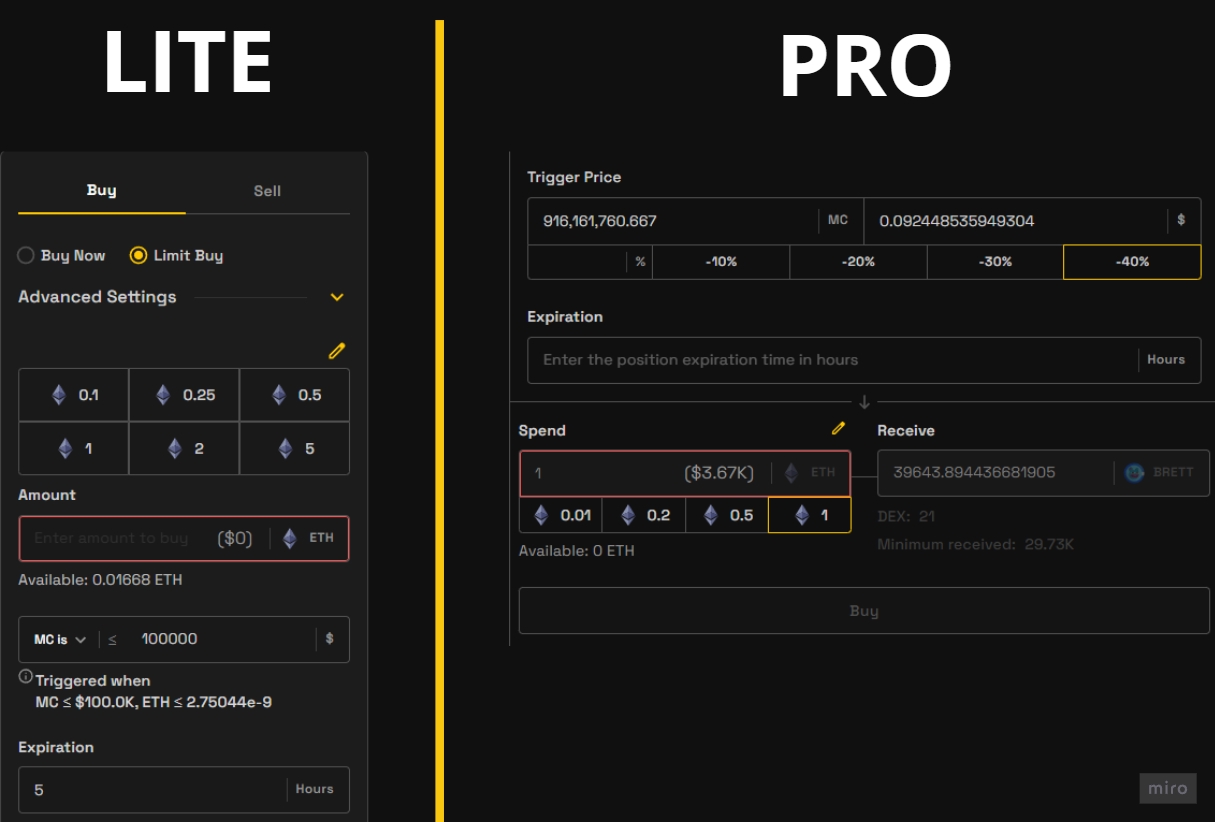

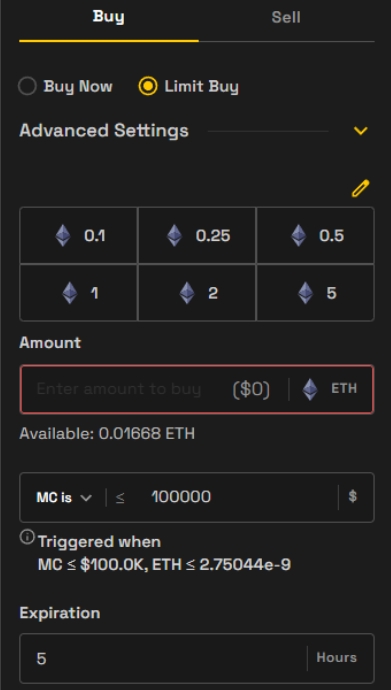

Follow these steps to create a limit buy order in the Lite version:

Select "Limit Buy" under the Buy section.

Choose Amount: Enter the amount of ETH you want to spend or use the preset values (e.g., 0.1, 0.25 ETH).

Set Market Cap Trigger: Enter the maximum market cap at which you want the order to trigger.

Advanced Settings:

Slippage: Customize slippage tolerance (e.g., 25%, 50%, 75%).

Priority (GWEI): Adjust transaction speed.

Expiration: Set a time limit for how long the order remains active.

Confirm: Click Buy to finalize your limit order.

The bot will automatically purchase the token when the price conditions are met.

⚡Ape perfect dips using limit orders Blazing WebApp

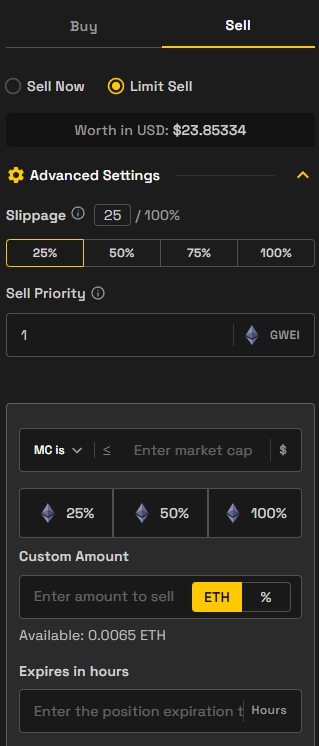

🏷️ Sell limit

Select "Limit Sell" under the Sell section.

Set Amount: Enter the amount of the token you want to sell or choose a percentage (e.g., 50%, 100%).

Set Market Cap Trigger: Input the desired market cap where you want the sale to execute.

Advanced Settings:

Slippage: Choose acceptable slippage.

Priority: Adjust GWEI for transaction speed.

Expiration: Set how long the order stays active.

Confirm: Click Sell to create the order.

⚡Try buy limits on Blazing WebApp now!

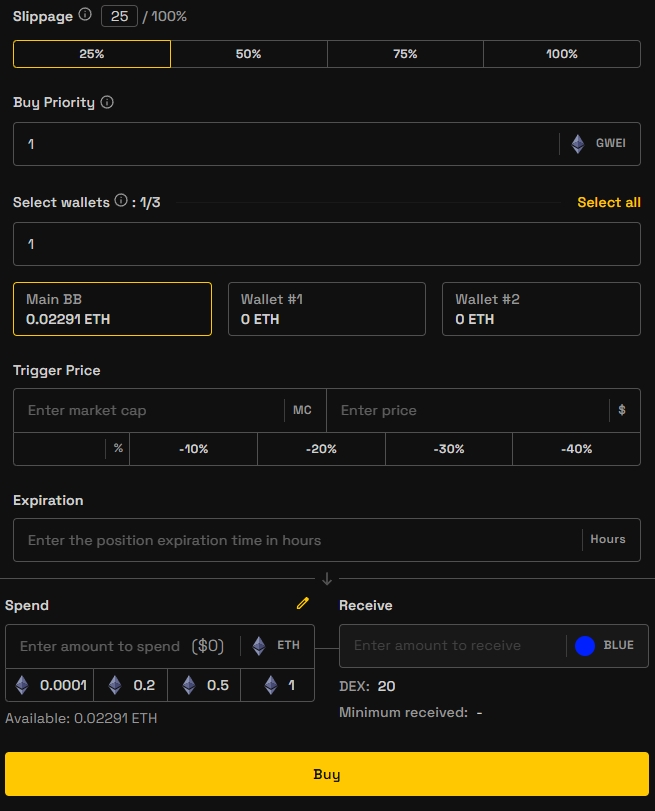

🛠️ Limit orders in the Pro version

The Pro version introduces additional features for advanced traders:

Percentage-Based Limit Orders:

Set percentage-based triggers (e.g., -40% for a dip buy or +40% for a profit take).

Multiple Wallet Selection:

Trade across multiple wallets simultaneously.

Enhanced Trigger Options:

Trigger orders based on both market cap and price volatility.

Example:

Buy: Set a limit order to trigger when a token drops -40% from its current price.

Sell: Sell automatically if market cap increases +50%.

📊 Best practices for using limit orders

Volatile Tokens: Use higher slippage for tokens with rapid price movements.

Gas Priority: Increase GWEI priority for time-sensitive trades.

Diversify Orders: Use multiple wallets for better execution speed.

Set Expirations: Limit orders will automatically expire after the chosen duration.

⚡ Key differences between Lite and Pro limit orders

Limit Buy & Sell

✅ Yes

✅ Yes

Market Cap Triggers

✅ Yes

✅ Yes

Price Percentage Triggers

❌ No

✅ Yes (-40%, +40%)

Multi-Wallet Trading

❌ No

✅ Yes

Advanced Priority Settings

✅ Basic (GWEI)

✅ Expanded (Multiple)

Expiration Control

✅ Yes

✅ Yes

🛡 Best Practices for Using Limit Orders

Use lower slippage settings during low volatility for tighter control.

Adjust GWEI priority during high network activity for faster execution.

Set expiration times to avoid orders lingering during market shifts.

Blazing App's limit orders give you full control over your entries and exits, ensuring you trade smarter in any market condition.

👉 Ready to trade? Launch Blazing WebApp now!

Last updated